/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

- #WHERE DO I MAIL MY 2016 TAX EXTENSION FORM FOR FREE#

- #WHERE DO I MAIL MY 2016 TAX EXTENSION FORM SOFTWARE#

- #WHERE DO I MAIL MY 2016 TAX EXTENSION FORM PASSWORD#

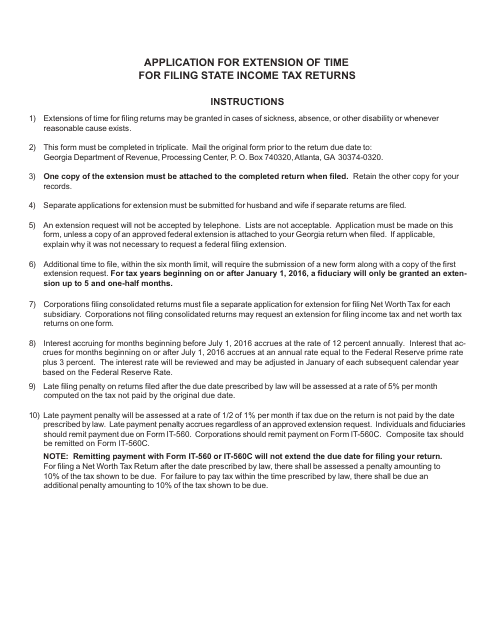

It will walk you through the information needed for Form 4868. (Doesn’t this kind of defeat the purpose?) After logging in, look for the big search box on the top right and type in the keyword “extend” to be directed to their extension section. They are rather vague on state tax extensions, stating that they will only show the state extension option where available after you have completed the majority of your state return.

#WHERE DO I MAIL MY 2016 TAX EXTENSION FORM FOR FREE#

also allows you to file a Federal extension online for free after signing up for a free account. I got my confirmation less than 3 hours after submission.

They will even send you a confirmation via e-mail or text message. If you wish to make a tax payment, you will be able to choose to pay with direct withdrawal from a bank account (account and routing numbers required) or pay with a credit card (IRS fees apply).Īfterward, you can confirm the status of your extension e-file by going to. If you don’t think you’ll owe any taxes, you can just put down zero as your expected tax liability.

If you fill out more details in the main software, then the estimate will be improved. TaxACT also provides a tax liability estimator to help you determine if you need to make a payment with your extension. TaxACT will file the form electronically for you (or you can print and snail mail). You will then be guided through the Form 4868 in a question-and-answer format. You will be able to choose whether to file extension for Federal, State, or both. To go directly to the extension form, click on the “Filing” tab on the left menu, and then the “File Extension” link right below it. Some states don’t even require a separate filing, but TaxAct supports the electronic filing of extension forms for the following states: If asked, just pick the “File Free” option, you shouldn’t need to enter any payment information. You don’t need to fill it out, just add it so they know what state you are filing for. Next, if you wish to perform a state tax extension, you must go to the “State” menu option on the left and add the appropriate state tax return.

#WHERE DO I MAIL MY 2016 TAX EXTENSION FORM PASSWORD#

You don’t need to actually use them to file your taxes later, although you certainly can.įirst, register for free at with your e-mail address and pick a password if you haven’t previously.

#WHERE DO I MAIL MY 2016 TAX EXTENSION FORM SOFTWARE#

Tax prep software allows you to e-File your Federal and State extension (where applicable) for free through them. This is how I usually do my extension because they include state as well.

If you file for an extension before midnight on that date passes, you can extend the time allowed to file your return by six months to October 17, 2022. This year, the deadline for federal tax filing is Monday, April 18th, 2022.

0 kommentar(er)

0 kommentar(er)